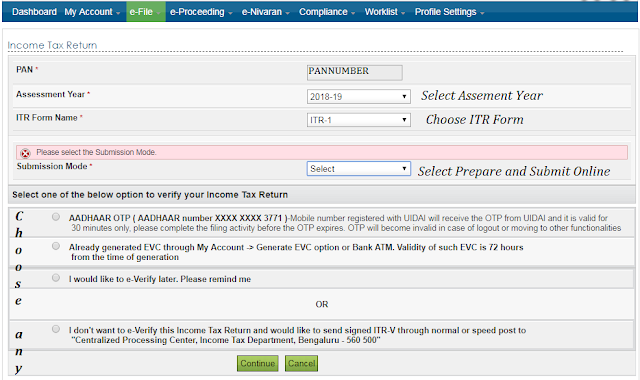

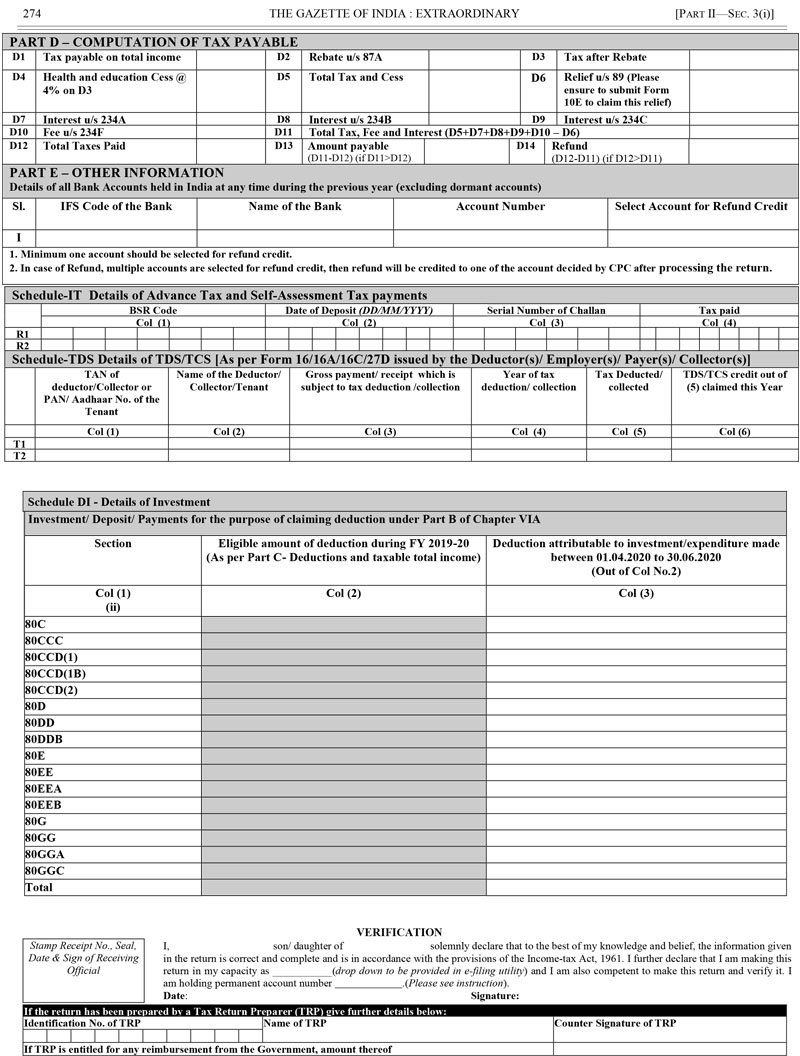

In this section you will find contents explained in a simple way and adapted to special needs. Once logged in, you can select the relevant ITR form and provide the necessary details such as personal information, income sources, deductions, and tax payments. To file online, you need to visit the official Income Tax e-Filing website and create an account. The acknowledgement form will be downloaded. Online filing is the most convenient and popular method. You can notify the Tax Agency of incidents or situations that may constitute tax offences or smuggling, or that may be of importance for the application of taxes. Step 3: To download ITR-V click on the ‘Download Form’ button of the relevant assessment year. After you have configured your SAML 2. Regulations and interpretative criteriaĬonsult the regulations and criteria of a general nature for the application of taxesĭatabase in question-answer format, with the main criteria for the application of tax legislation.If you have made a mistake when filing a tax return, here is what to do How to modify a tax return already filed.General and technical information for the electronic supply of invoicing records through the AEAT web site Receive information alerts from the Tax Agency by e-mail or mobile phone. Request and download documents proving your tax status Find out how to access the electronic reference number, certificate, electronic DNI, etc.

0 kommentar(er)

0 kommentar(er)